A compensation scheme called the COVID Restrictions Support Scheme (CRSS) will provide support for...

Business Resumption Support Scheme (BRSS)

The Business Resumption Support Scheme (BRSS) provides a once-off payment of up to €15,000 to businesses who commenced trading no later than 26 August 2020 and who have been significantly impacted by restrictions imposed due to the Covid-19 pandemic. A BRSS claim can be made by a business irrespective of whether they have previously qualified for other Covid-19 related Government schemes including the Covid Restrictions Support Scheme (CRSS).

Application Period

A business must make a BRSS claim between 1 September 2021 and 30 November 2021 (the ‘application period’) and any claim outside of this period will not be accepted. A claim must be made through ROS and the portal for registering and making a claim will open in early September.

Who may qualify for BRSS?

The scheme is open to persons carrying on a relevant business activity which includes self-employed individuals, partnerships and companies carrying on a trade, the profits from which are taxable under Case I of Schedule D. Certain charities and sporting bodies who carry on a trade and the profits from which would be chargeable to tax under Case I Schedule D but for the available charity and sports body tax exemptions may also qualify for BRSS.

Revenue Guidance on the operation of the BRSS dated 7 July 2021, includes examples of businesses which may qualify for BRSS being pubs, hotel suppliers, coach operators, sporting clubs and charity shops.

How to qualify for BRSS?

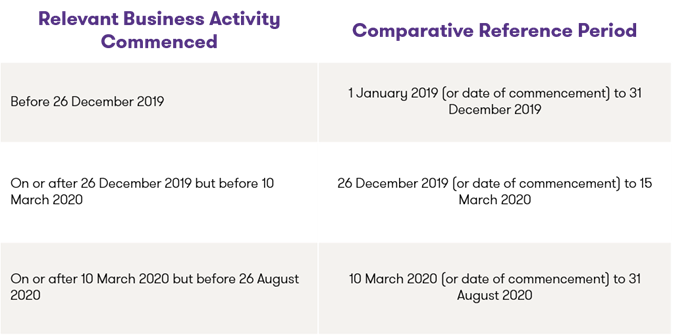

To qualify for the scheme, a business must demonstrate that the turnover of the business is adversely effected during the period from 1 September 2020 to 31 August 2021 i.e. that the turnover from its trade will be no more than 25% of a reference turnover amount (average weekly, VAT exclusive, turnover multiplied by 52 for the relevant business activity in a defined comparable prior period). The comparative reference period will depend on the commencement of the relevant business activity as follows:

To be eligible for BRSS a business must have commenced no later than 26 August 2020.

Other Qualifying Criteria

To make a claim for the scheme, a business must also meet the following conditions:

- The claimant has an up-to-date tax clearance certificate;

- They have complied with their VAT obligations;

- They are not entitled to make a claim for the CRSS scheme in respect of any week that includes 1 September 2021; and

- The business is actively carrying on its trade and has an intention to continue to do so.

The scheme operates on a self-assessment basis. Any person making a claim is required to maintain and have available such books and records as may be reasonably required for the purposes of demonstrating that the person is eligible to make a claim under the scheme and to support any amount claimed.

Similar to other Covid related business support schemes, BRSS legislation provides for the publication of the names of claimants on the Revenue website.

Amount that can be claimed

Qualifying businesses will be able to make a claim for a single payment (known as an Advance Credit for Trading Expenses ‘ACTE’) equal to three times the amount of:

- 10% of the average weekly turnover during the reference period up to a maximum weekly turnover of €20,000, plus

- 5% of any excess average weekly turnover over €20,000

subject to a maximum total BRSS payment of €15,000

Where a business has more than one relevant business activity, the BRSS payment will be related to the trade and not the business premises, as is the case for CRSS payments. For example, where a single trade is carried out from two premises, a single BRSS payment may be claimed where eligibility conditions are met. On the reverse, where two trades are carried out from a single premises a BRSS claim may be made for both relevant business activities such that up to a maximum of €15,000 may be claimed for each trade.

Contact

Contact a member of the RDA Team to discuss your eligibility for the BRSS and how we can assist you in making the claim.