The Covid-19 pandemic has forced every business to look ahead and answer questions they’d never had...

What is Financial Master Planning?

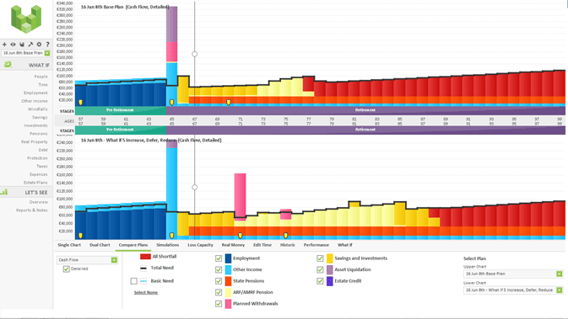

It is the process of assessing your current and forecasted wealth, along with inflows (income) and outflows (expenditure), to enable a picture to be created of your finances both now and in the future. Financial Master Planning allows you to reflect on your current financial position relative to your preferred position, enabling you to make provision or take action now to ensure you achieve your personal aspirations in the future. The Financial Master Plan will give a detailed picture of your assets, investments, debts, income and expenditure, projected forward, year by year, using assumed rates of growth, income, inflation, and interest rates.

Growth rates are cross-referenced with your attitude to risk to ensure your expectations are realistic and compatible with the asset allocation needed to achieve the necessary growth rate. It will help to highlight or expose any shortfalls in your existing financial plan which can then be subsequently addressed at an early stage in the financial planning process.

Most clients have bits and pieces of wealth scattered around in various places and don’t actually know what it all adds up to. This also means they are oblivious as to how far their existing arrangements will go towards their financial objectives or what way they should draw down on this accumulated wealth in the future. Financial Master Planning puts a spotlight on this and helps to provide some indication of what one may expect to achieve in the future.

Who is Financial Master Planning For?

Financial Master Planning is for anybody who wants to plan for retirement. It can help answer questions like ‘how much is enough?’. Many clients have no idea of this figure, so they keep on saving… often at the expense of living a better lifestyle today.

This exercise can highlight the fact that clients have more than enough, and it is in fact ‘time to spend!’.

Financial Master Planning can also be very effective when clients have a big decision to make and want to know the financial outcomes of whatever decision they make.